By John Sandbakken*

Who needs crop insurance? Would you ever think of going without crop insurance to help cover your risk? I don’t think so, because one bad year could have devastating financial consequences.

You are not alone; crop insurance is purchased by more than 90% of agricultural producers to protect themselves against either the loss of their crops due to natural disasters, or the loss of revenue due to declines in the prices of agricultural commodities. Having crop insurance probably allows you to sleep better at night knowing you have some protection from the factors outside of your control, like volatile markets and Mother Nature.

Crop insurance for sunflower is available in more than 300 counties in Colorado, Kansas, Minnesota, Montana, Nebraska, North Dakota, Oklahoma, South Dakota, Texas and Wyoming. If crop insurance for sunflower is not available in your county, have your crop insurance agent check into obtaining a written agreement at the USDA Risk Management Agency (RMA) Regional Office that covers your state. A written agreement is a document designed to provide crop insurance for insurable crops when coverage or rates are unavailable in a particular county. RMA has 10 regional offices in various locations across the country that you may contact for information specific to your area using this link: www.rma.usda.gov/RMALocal/Field-Offices/Regional-Offices

When insuring sunflower, you have four crop insurance choices: Yield Protection (YP), Revenue Protection (RP), Revenue Protection with Harvest Price Exclusion (RPHPE) or Whole Farm Revenue Protection (WFRP). The “Basic Provisions” are the same for all crops and all policies, making paperwork much simpler to digest.

Revenue and yield policies have the same (minimum) starting price and are based on December soy oil prices traded on the Chicago Board of Trade during February and October. If you are interested in following spring and fall price information for all crops covered by crop insurance, use this link: prodwebnlb.rma.usda.gov/apps/PriceDiscovery — then click on ‘Your Price’ or ‘Many Prices.’ It will allow you to see how prices are tracking.

Final Planting Dates

NSA offers maps of final planting dates for Colorado, Kansas, Minnesota, Montana, Nebraska, North Dakota, South Dakota and Wyoming that can be found on the NSA website — www.sunflowernsa.com. Go to the “Growers” link, then “Crop Insurance.”

The final planting date as listed on these maps is the last day that you can plant the crop and still get full coverage. After this date, the coverage is reduced by 1% per day. The actual final date that RMA allows the crop to be planted with reduced coverage is anywhere from 20 to 25 days after the date listed on the NSA maps, depending on the county.

What’s New for 2026?

Last year was a big year for positive changes to the crop insurance program. The One Big Beautiful Bill Act (OBBBA), enacted on July 4, 2025, made changes to the Federal Crop Insurance Act. These changes include expanding benefits for beginning farmers and ranchers, increasing coverage options, and making crop insurance more affordable.

Enhanced Support for Beginning Farmers & Ranchers

Under the new legislation, beginning farmers and ranchers will receive substantially increased premium support during their first decade of farming operations, making crop insurance more affordable for the next generation of American agricultural producers. The enhanced benefits mean beginning farmers and ranchers will now receive:

• 15 percentage points additional subsidy for the first two crop years.

• 13 percentage points for the third crop year.

• 11 percentage points for the fourth crop year.

• 10 percentage points for years five through 10.

These benefits build upon existing support that waives administrative fees and provides base premium subsidies.

A beginning farmer or rancher is now defined as an individual who has not actively operated and managed a farm or ranch for more than 10 crop years.

Crop Insurance More Accessible with Expanded Coverage Options

The legislation makes crop insurance more accessible and affordable through important improvements to area-based crop insurance programs:

• Whole Farm Revenue Protection (WFRP) maximum coverage level increase from 85% to 90%, providing producers with enhanced protection for diversified operations.

• Supplemental Coverage Option (SCO) premium support increase from 65% to 80%, making this valuable gap coverage more affordable. Additionally, producers can now purchase SCO regardless of their Area Risk Coverage (ARC) elections with the Farm Service Agency, dramatically increasing accessibility.

• Enhanced Coverage Option (ECO) and similar programs, including Margin Coverage Option (MCO), Hurricane Insurance Protection Wind Index (HIP-WI) and Fire Insurance Protection Smoke Index (FIP-SI), will also receive the increased 80% in premium support, making comprehensive coverage more affordable than ever.

• SCO coverage will also expand to a coverage level of 90% (from 86%). Producers will have access to this option in 2026 via the ECO product, which has identical coverage at the same cost and premium support levels. USDA will then change the SCO policy for the 2027 crop year.

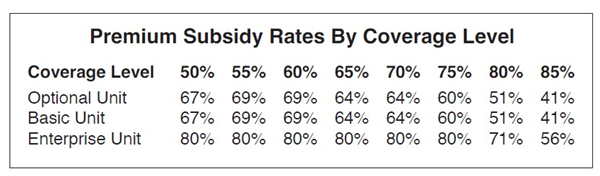

The legislation delivers unprecedented improvements to premium support rates across coverage levels and unit structures, with particular emphasis on supporting enterprise and whole farm units. The new subsidy structure maintains strong support for higher coverage levels while ensuring maximum affordability across the risk management spectrum.

The above table shows the updated premium subsidy rates for different insurance coverage and unit elections for policies that use the Common Crop Insurance Policy, Basic Provisions (CCIP).

Other things you should consider when sitting down with your local crop insurance agent when making decisions on how to insure this year’s crop.

Master Yields & Enterprise Units By Crop Type for Sunflower

Master Yields (MY) are available in Colorado, Kansas, Minnesota, Montana, Nebraska, South Dakota and Wyoming. Sunflower is grown in a longer rotation and has multiple types (oil vs. confection), which can lead to a very slow process to populate a grower’s actual production history (APH) dataset. MY gives producers the option of obtaining more-effective crop insurance protection for sunflower when they have four (4) or more years of records for sunflower within a county.

MY is not available to North Dakota producers, as they currently have the option of using Personal Transitional Yields to populate their APH dataset.

Producers are allowed to have Enterprise Units by crop type for sunflower. This additional option enables producers to be indemnified separately by sunflower type. The benefit for producers is that a gain on one type (e.g., confection type) does not offset the loss payment on another type (e.g., oil type).

Having enterprise units by sunflower type means strengthened coverage options and increased consistency, clarity and flexibility, making crop insurance a better risk management tool for sunflower producers.

Quality Loss Option (QL)

QL is an option you may elect to improve your APH for years in which you suffered a quality loss. In electing QL, you may choose to replace post-quality adjusted production to count with pre-quality adjusted production to count for crop years in your APH database.

Starting in 2021, you could elect the QL for those crop years in your APH database that experienced decreased production to count (PTC) due to quality discounts. The PTC for these crop years can be replaced with pre-quality adjusted PTC if a Notice of Loss was filed in that crop year.

QL is available for YP, RP and RPHPE policies.

Trend-Adjusted APH

Trend-Adjusted APH will give you some options when buying crop insurance in 2026. If the same percent guarantee is chosen, the dollar value of coverage will be increased and the premium you pay will be slightly higher.

As an alternative, you can elect a lower percent guarantee for approximately the same dollars of coverage. The total premium would be the same as before, but your share of the premium would be smaller because the percent subsidy from the USDA is higher for lower percent guarantee levels.

The Trend-Adjusted APH is available for either yield protection or revenue protection policies, at all levels of guarantee except catastrophic (CAT) coverage (50% yield guarantee). The Trend-Adjusted APH election must be made by the insured producer by the sales closing date each year, which is March 15 for sunflower in eligible counties.

Actual Production History Yield Exclusion (YE)

Under this program, yields can be excluded from your APH when the county average yield for that crop year is at least 50% below the 10 previous consecutive crop years' average yield. The YE allows eligible producers who have been hit with severe weather, including drought, to receive a higher approved yield on their insurance policies through the federal crop insurance program. The following link shows an interactive map that allows you to see which counties have YE: https://public-rma.fpac.usda.gov/apps/MapViewer/index.html.

When formulating your crop insurance plan for 2026, you’ll have to crunch the numbers to see what is the best risk management plan for your operation, given current prices. The best advice is to sit down with your local crop insurance agent to understand how these new changes created by the OBBBA will benefit your operation. Your local insurance agent can describe the different insurance products available, and the policy rates and terms. He or she will help you choose the best coverage for your crop based on your particular farm operation and your risk management and budgetary needs.

* John Sandbakken is executive director of the National Sunflower Association.